We Are The Only Pay-Per-Lead SEO Specialist Agency.

Driving growth with funding-ready leads, one verified prospect at a time

Get Funding-Ready Leads

2+ Million

Financial Leads Generated

98% Success

Rate in Lead Validation

35% Reduction

in Customer Acquisition Costs

100+ Financial

Brands and Companies Served

We Provide Organic Funding-Ready Leads

The financial niche is highly regulated and ultra-competitive, and customer acquisition is costly. We specialize exclusively in organic lead acquisition for the financial sector, focusing on FCA, GDPR, and ISO27001-compliant niches. Our innovative approach ensures you receive not just any leads but funding-ready leads that meet rigorous validation standards, including affordability assessments, creditworthiness checks, and more.

The First Pay-Per-Lead SEO Solution in the Financial Industry

We are the first and only SEO agency paid by the financial leads we deliver—not for content, inks or Digital press releases. This groundbreaking model ensures that our interests are perfectly aligned with our customers. You only pay for what truly drives your business forward: qualified leads ready to take action. No more wasting budget on traffic that doesn’t convert or leads not primed for funding.

Comprehensive Lead Validation

Every lead we generate undergoes a series of stringent checks to ensure it meets the highest standards:

Dynamic Cost of Living Challenges: We dynamically assess cost of living factors to ensure leads are financially stable and capable of making informed decisions.

Affordability Assessments: We analyze the financial situation of each lead to ensure they can afford the products or services they’re interested in.

Credit Worthiness Checks: We conduct thorough credit checks to verify the financial reliability of each lead.

Fraud Prevention: Our leads are screened for potential fraud risks, protecting your business from costly setbacks.

Contact Detail Validation: We validate contact information to ensure you’re reaching real, engaged prospects.

Income Validation with Open Banking: We verify income through secure open banking channels to confirm eligibility.

Focused on Financial Lead Generation in the UK Market

With deep expertise in the UK market, all our campaigns (content, link anchors, and DPRS) are created based on the UK Financial Conduct Authority (FCA) guidelines. Unlike traditional SEO agencies, which work to provide traffic, we aim to deliver regulated companies with safe and high-quality customers who are currently looking to obtain credit online.

2+ Million

Funding-Ready Leads Provided

£70 Million+

Client Revenue Driven by Our Leads

How to Get Started: Your 3-Step Plan to High Quality Financial Leads

Start getting the highest quality, fully vetted financial leads on a pay-per-lead basis.

1

Schedule a Free Consultation

Connect with our team to discuss your financial lead gen needs and customer acquisition goals with our team.

2

Customized Lead Generation Strategy

We’ll create a Pay-Per-Lead SEO plan targeting funding-ready leads, adhering to FCA, GDPR, and ISO27001 guidelines.

3

Receive Qualified Leads

Start receiving high-quality, funding-ready leads. You only pay for leads that we send you that meet your criteria.

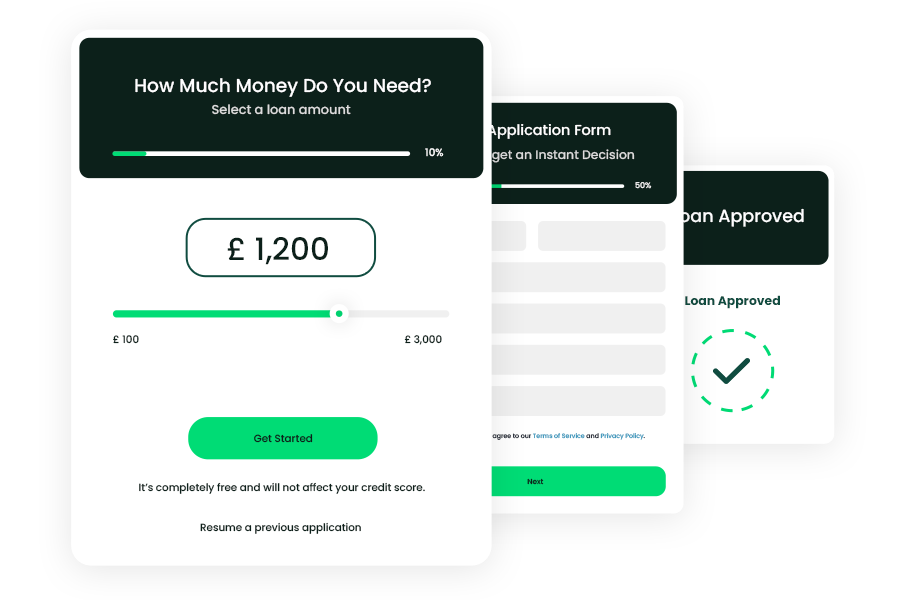

Fundable Leads Through Technology

From loan applications to affordability assessments, creditworthiness checks, and decisioning – we use our bespoke credit technology to validate the fundable leads we sell.

Apply Now

Why You Should Only Work with a Pay-Per-Lead SEO Specialist Agency

By sticking to outdated customer acquisition methods, you risk wasting valuable resources on traffic that doesn’t convert. This can result in missed opportunities to connect with high-quality leads who are ready to take action, ultimately slowing down your business growth.

Without using validated leads, you might end up with contacts that aren’t financially stable or serious about your services. This can lead to increased costs from chasing down unqualified prospects, more time spent filtering out bad leads, and lower conversion rates, all of which harm your bottom line.

If you don’t account for dynamic cost of living factors, you risk targeting leads that aren’t financially capable of making informed decisions. This could result in higher default rates, increased risk of non-payment, and damage to your business’s financial health.

Neglecting fraud prevention can expose your business to serious risks, including financial losses, damage to your reputation, and legal consequences. Ensuring that your leads are thoroughly screened for fraud is essential to protecting your business from costly setbacks.

Paying for traffic rather than qualified leads can lead to inflated marketing costs with little to no return on investment. This inefficiency can stall your business’s growth and limit your ability to reach and convert truly interested prospects.